|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Fix Insurance: A Comprehensive Coverage GuideFor many U.S. consumers, understanding car fix insurance can be a game-changer when it comes to vehicle protection and managing repair costs. Whether you're driving through the bustling streets of New York or the scenic routes of California, knowing your options can provide peace of mind. Understanding Car Fix InsuranceCar fix insurance, also known as extended auto warranties, offers coverage that goes beyond the standard manufacturer's warranty. This type of insurance can cover a variety of repairs and parts, giving you financial security when unexpected issues arise. Benefits of Car Fix Insurance

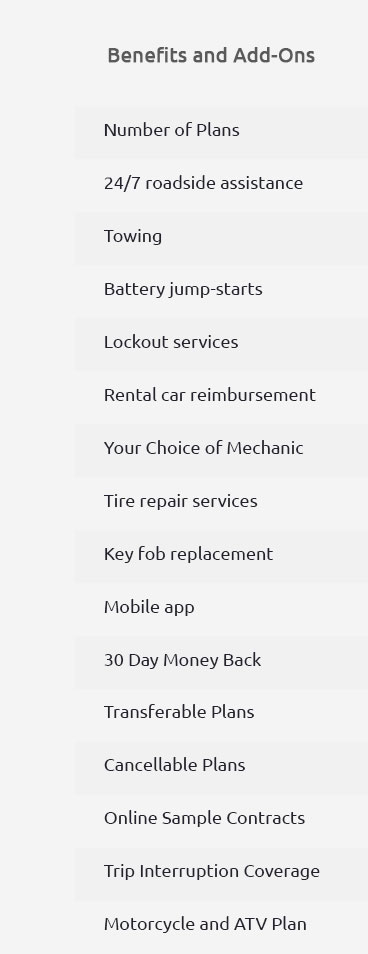

For those looking for more details on extended warranties, consider checking out used auto extended warranty reviews to make an informed decision. Types of CoverageBasic Powertrain CoverageThis is the most fundamental type of coverage, typically focusing on essential components like the engine and transmission. Bumper-to-Bumper CoverageOften referred to as exclusionary coverage, this option covers almost all parts of the vehicle, with a few exceptions. Specialized Component CoverageSome policies offer coverage for specific parts, such as the air conditioning system or electrical components. For residents in Massachusetts, you might want to explore options specific to your area by visiting used car warranty ma. Choosing the Right PolicyWhen selecting a car fix insurance policy, consider the following:

Ultimately, the right policy will depend on your individual needs and circumstances. Take time to compare different options and read reviews from other consumers. Frequently Asked QuestionsWhat is car fix insurance?Car fix insurance is a type of extended warranty that covers repair costs beyond the manufacturer's warranty period, offering peace of mind and cost savings for vehicle owners. Is car fix insurance worth it for older vehicles?Yes, older vehicles, especially those with higher mileage, can benefit from car fix insurance as they are more prone to unexpected repairs. How do I choose the best car fix insurance?To choose the best car fix insurance, consider your budget, the vehicle's age, and your driving habits. Comparing policies and reading reviews can also help in making an informed decision. In conclusion, car fix insurance offers significant benefits to U.S. consumers by providing coverage that can alleviate the financial burden of vehicle repairs. By understanding your needs and researching available options, you can select a policy that ensures your peace of mind on the road. https://www.caranddriver.com/car-insurance/a36118808/does-auto-insurance-cover-repairs/

Also referred to as mechanical breakdown insurance (MBI), this type of insurance is available from major insurers and can save you from paying ... https://www.valuepenguin.com/car-repair-insurance-after-car-accident

Car insurance will pay for car repairs after a car accident. It may also pay to repair damage after events like theft or a hailstorm. https://www.nolo.com/legal-encyclopedia/car-accident-vehicle-damage-your-auto-repair-options.html

Regardless of whose insurance company is responsible for paying your repair costs, the first thing that you ...

|